Logistics real estate company WDP saw its property values rise in the first nine months of the year, but these were completely wiped out by a significant €407 mln write-downs in the fourth quarter of 2022. WDP’s write-downs showed that the real estate market changed completely in the fourth quarter of 2022.

Higher financing costs mean investors are willing to pay less for the property, and sales prices are falling. Especially in the Netherlands, the real estate has already been written down because more transactions are taking place in that market, and appraisers are, therefore, somewhat quicker to arrive at write-downs, according to CEO Joost Uwents in FD.

Despite the higher financing costs, CEO Uwents is still optimistic. Despite the write-down, WDP has a relatively low loan-to-value ratio of 35%. WDP’s storage centers and distribution halls are practically full, with an occupancy rate of 99.1%. Demand for logistics property remains high in WDP’s vital Netherlands and Belgium home markets. This is reflected in rental income, which rose 14% last year to €292.9 mln compared to 2021.

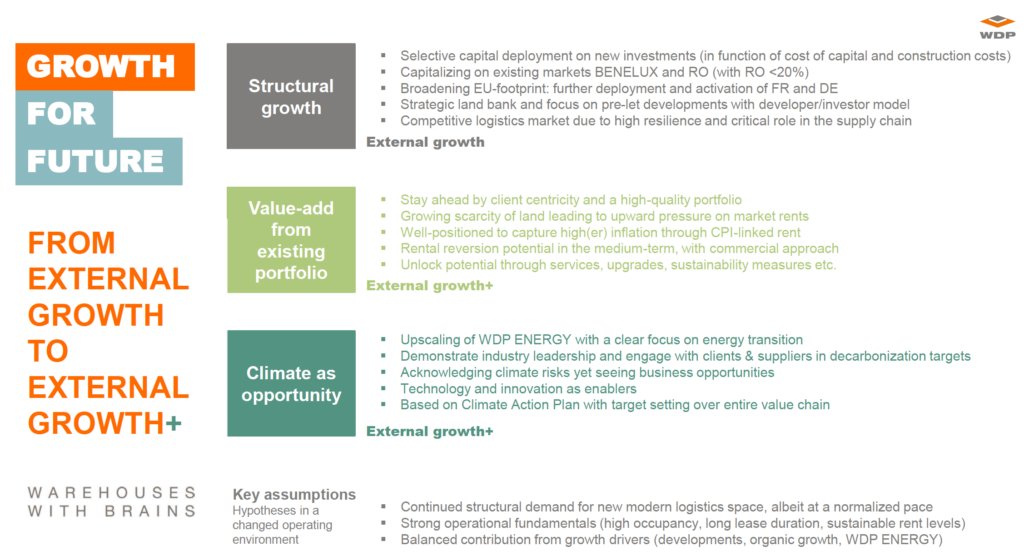

‘We have become stricter in selecting new projects. Where we used to say we lived on external growth, we now try to add value from the existing portfolio.’ By that, CEO Uwents means he hopes for rent indexation, making existing buildings more sustainable, and expanding the solar panel division that WDP recently created.

The EU Green Deal requires transport to decarbonize and incentivizes a switch to e-mobility to attain a fully sustainable supply chain. Energy transition has gained momentum due to current geopolitical tensions and the ensuing energy crisis. Fast, sustainable, and flexible delivery of goods requires a changed infrastructure. Warehouse sites can be crucial in decarbonizing their customer’s supply chain through warehouse buildings and clean transport. The ambitioned total capacity is 150 MWp by 2023. Combined with infrastructure for on-site consumption and matching energy consumption and production. Charging at logistics real estate is the new gold?

Source: WDP