Supply chains have been the lifelines of globalization, delivering lower costs and higher efficiencies to production and gains to businesses and consumers worldwide. However, the pandemic, geopolitical tensions, and the increasing importance of sustainability and speed to consumers are changing how companies think about globalization and supply chains. Supply chains were previously organized to minimize costs: manufacture where labor is cheapest and maintain the minimum amount of JIT inventory to allow goods to flow. This paradigm is changing towards near-shoring and on-shoring.

In choosing the right design of production and distribution networks, service, cost, and risk still play a decisive role. Buck Consultants International (BCI) and Supply Chain Media conducted research among 150 supply chain leaders from Europe and the US.

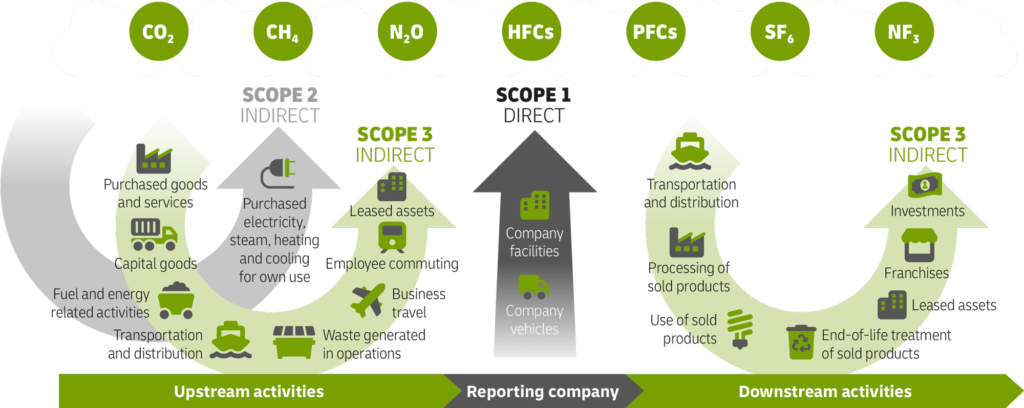

CSRD: carbon accounting

Carbon accounting, the mapping of emissions in all steps of the production and distribution process, is still in its infancy, but the need to steer based on good data is increasing. According to the recent BCI study, only one in three companies has organized carbon accounting (measuring CO2 emissions throughout the production and distribution chain) adequately and across the entire chain. In many companies, measuring CO2 emissions is still in its infancy. This is worrisome because European regulations with the Corporate Sustainability Reporting Directive will require a small 50.000 companies directly, but many more companies indirectly, to report carbon emissions, among other things, by 2025.

On- and near-shoring

The most crucial CO2 reduction measure that companies (will) take is rearranging the network of factories: by moving production capacity from China and Asia to Western Europe (‘on-shoring’) or Central and Eastern Europe (‘near-shoring’), not only does the entire supply chain become less vulnerable to disruptions, but CO2 emissions can be reduced at the same time.

Nearshoring has implications for different types of businesses for various reasons. For instance, industries that require a high degree of customization or shorter lead times, such as the fashion industry, will likely benefit from nearshoring. Additionally, locations that already are or are close to existing manufacturing hubs and have good infrastructure and a skilled and low-cost workforce are likely to attract more nearshoring investments as industries evolve. The large central inventory held in European distribution centers might even disappear.

Decarbonising supply chains

The introduction of the EU Emissions Trading System (EU) ETS will push the need for decarbonization by pricing CO2 emissions. The EU ETS is a cornerstone of the EU’s policy to combat climate change and its essential tool for reducing greenhouse gas emissions cost-effectively by putting a cost on CO2 emissions.

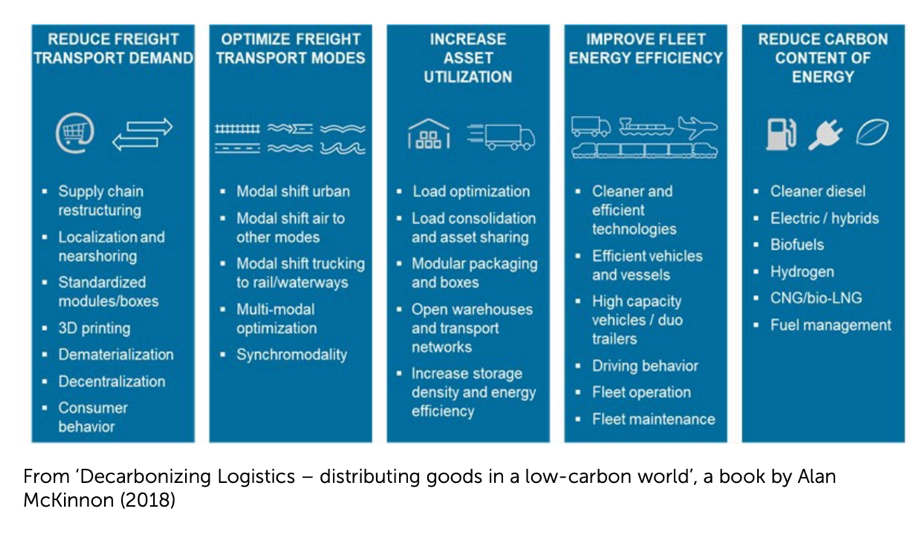

Decarbonizing supply chains (as one of the significant trends) will have implications for the location of suppliers, production, and distribution facilities (and facilities supporting circular flows). The design of a supply chain directly impacts scope 1, 2, and 3 emissions. Transport and warehousing emissions could be 5 to 10 percent of total emissions. Prof. McKinnon offers excellent insights into the roadmap for decarbonizing transport and warehousing. Supply chain restructuring, localization, and near-shoring are ways to reduce freight transport demand.

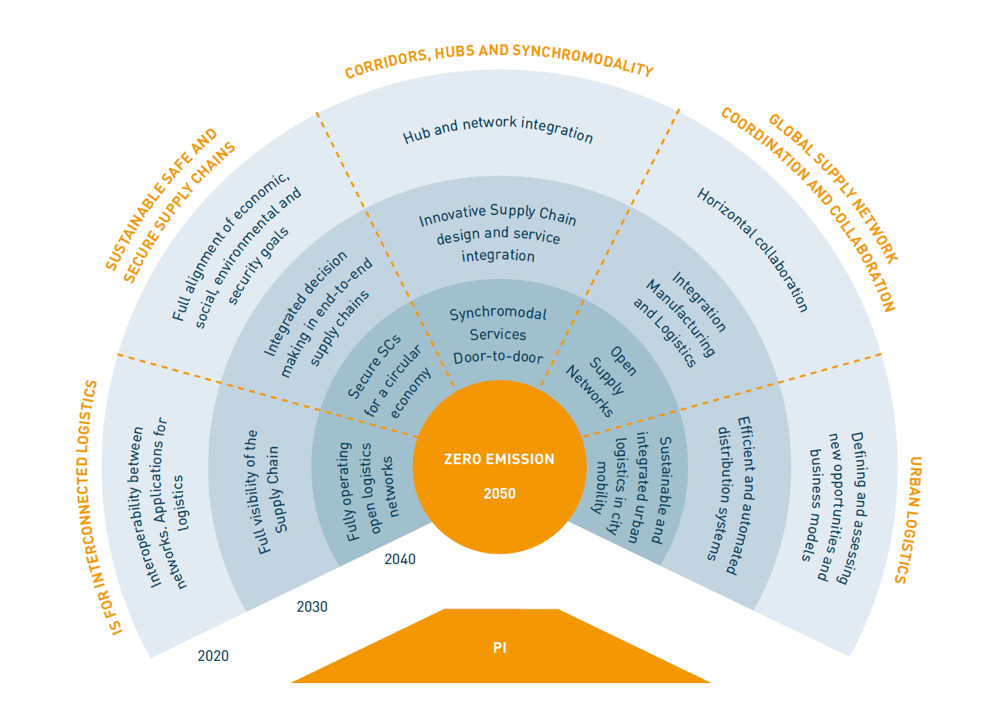

Linking the first mile to the last mile: the physical internet

Near-shoring and on-shoring will inevitably lead to more fineness, dynamics, and complexity upstream in the European-based supply chains. There is a need for large-scale and sustainable collection systems for first-mile form European suppliers and factories to local and regional distribution centers.

Data plays the leading role in communication with city hubs and facilitates dynamic planning. Transport capacities are shared with colleagues or with transport platforms. This is not business as usual. It is a fundamental innovation in ‘fluff’ and ‘stuff,’ e.g., the Physical Internet.

The logistics sector should move to a paradigm where they can do more with less. In parallel to developing lower and zero-emission vehicles and low-emission energy, leveraging opportunities for increased logistics efficiency is critical. The Physical Internet envisions essential benefits for all stakeholders by doing more with less in the freight and transport industry. The existing idle capacity of assets in all modes of transport and storage could be better utilized, and flows could be managed more broadly using and combining transport modes and other logistics assets smartly.

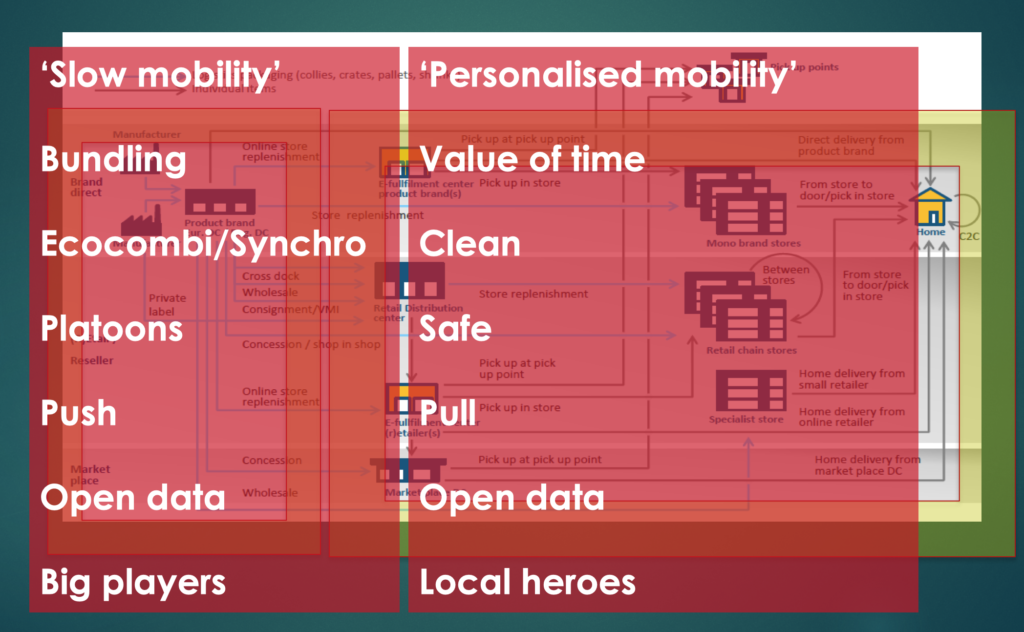

City logistics hubs offer a solution where efficient and sustainable bulk deliveries from factories, container terminals, and distribution centers to the region are done with ‘slow mobility’ (and why not by water?) and transferred to just-in-time deliveries that are precisely tailored to the demands of the customer in the city; the consumer, the construction site, the office, the retail store, and HoReCa.

Sharing is caring. Shippers and logistics service providers will work closely in future city logistics hubs. The partners in the city logistics hubs add value in unpacking, installation, returns, stock keeping, the zero-emission ‘last mile’ to the customers, and smart energy solutions. The economy of scale is a prerequisite for successful collaboration.

Traditionally, city logistics was all about ‘stuff’: pallets, barcodes, and vans. The new city logistics requires ‘fluff,’ the smart use of data in collaborative planning and execution. With infrastructural changes in Europe, road pricing, the need to reduce CO2 for the Paris Climate Agreement (and CSRD), and new zero-emission zones, the right hub near the city will be critical for shippers and logistics service providers in city logistics.

City hubs as ecosystems

With the limited space available, this issue of where to locate your last-mile operations can no longer be postponed. The challenge for companies is to develop new business models together. Business models link innovative light industrial manufacturing, logistics, and service processes (stuff) to the smart use of data (fluff). In recent years, cities have focused on developing urban innovation districts around knowledge institutes and business clusters for the development of start-ups and innovative business models. City logistics business parks will become ecosystems where companies will test and improve last-mile technology, services, and business concepts in local living labs and innovation districts.

Walther Ploos van Amstel.