Based on a global survey of logistics and transportation leaders, the 2021 Bringg Survey Report State of Last Mile Logistics report examines logistics provider’s current pains and presents gaps between provider capabilities and current shipper demands. It also provides tips to overcome the challenges and facilitate long-term growth.

Visibility is set to be a key differentiator for all stakeholders

There is a clear need for visibility across the supply chain; 53% of respondents say their shippers use or have requested real-time visibility tools for end customers, and respondents listed visibility into order requirements as the tech capability that would most increase driver retention. However, only 18% of respondents offer real-time visibility today – and over half have no plans to purchase. Real-time visibility is rapidly turning into a differentiator, as shippers, drivers, and customers look for logistics providers who can supply it across the delivery flow.

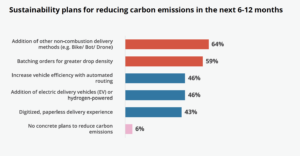

Companies differ on the smartest route to sustainability

Sustainability is firmly on the roadmap, across regions. UK logistics leaders lead EMEA in terms of prioritizing sustainability practices (88% marked it as ‘high’ or ‘very high’), while the U.S. lags behind its European counterparts (74%) In terms of the route to sustainability, larger companies with the budget for it are looking to improve sustainability with operational changes or investments such as EV fleets. Smaller budget companies, however, are more likely to be incentivizing consumers to pick from available sustainable options, with 42% of respondents from companies with less than 500 people looking for ways to make that happen.

Logistics stakeholders are looking for innovative technology

A lack of innovative tech is the biggest obstacle to scaling last-mile operations. 41% of respondents say their biggest blocker is their outdated business processes and manual operations, while another 36% point to legacy technology. The challenge of legacy technology increases in line with company size, with almost half of respondents (48%) in companies of more than 1,000 people calling it their greatest blocker. Moreover, 3 of the top CX capabilities used or requested from shippers all relate to creating a streamlined digital delivery experience for their customers.

Logistic leaders have clearly identified that they want automation

Automation is the primary tech tool that providers are looking at for improving customer experience and managing the growth of delivery volumes. There are too many packages, too many orders, and 98% of survey respondents say they are being impacted by the growth of eCommerce. 54% of logistics providers are focused on adding automation to meet this challenge, and in fact – 41% already have done. An underlying theme for logistics in the next 2 to 3 years will be extending this automation across the delivery cycle, and “doing more with less”.

Automation needs to be cost-effective, not just improve processes

It is interesting to note that automation is closely linked to business goals for reducing costs. The top abandoned technology for today’s logistics and transportation providers, for example, is automated scheduling and self-scheduling. 20% of people said this was too expensive, and only 2% said it was not a good fit. We can also see that it was the top wish-list item for 61% of LSPs. The same cost/benefit disparity was found with other automation technologies, such as driver flows and visibility technology, where the primary driver for abandonment in both cases was high costs.

As stakeholders increase their network, technology becomes critical to new delivery models

When asked about the top 3 customer experience capabilities requested from shippers, 45% of respondents named installation and assembly services. Fully 64% are planning to offer new premium services and service plans to increase business through last-mile operations this year. The top response to the technologies that are enabling these new delivery models are intelligent and easy integrations, at 43% of the results, (and 30% higher than the next answer, business analytics). For logistics and transportation providers, digitally connecting their ecosystem is the route to lower the cost of automation and add visibility, opportunities for sustainability, and ultimately better customer experience and control.

Technologies helping increase driver retention

As logistics providers are adding more capabilities and service models, the complexity grows for the drivers. When asked which technologies will help increase driver retention, the top three technologies accounted for 71% of responses. The number 1 technology selected by 27% of survey respondents was better visibility into order requirements of delivery flow (e.g. requirements for each stop).

This was followed by automated driver payment (25%) and dynamic routing (19%). As delivery volumes grow and new services become more popular, the delivery itself becomes more complex. Drivers need tools to handle deliveries where every order may contain different requirements, such as digital proof of delivery or over-the-threshold delivery.

Source: Bringg