The market for vehicle routing and scheduling and last-mile applications continues to grow as organizations are seeking ways to optimize fleet operations. Gartner presents a market guide.

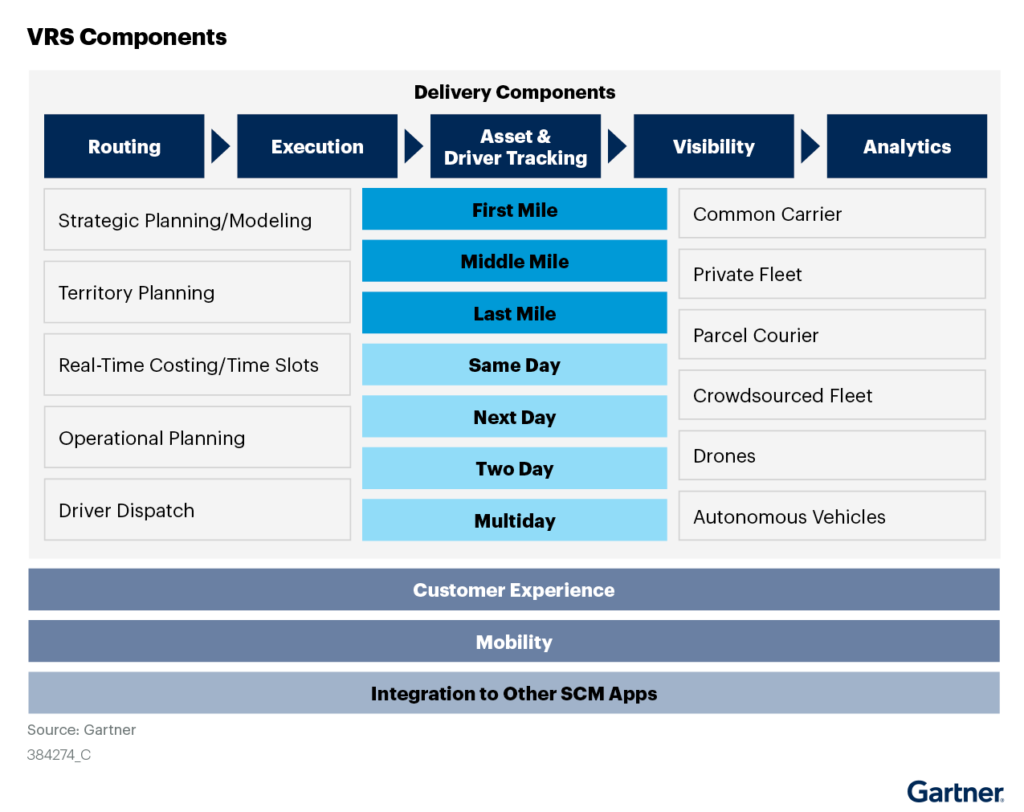

Last-mile delivery solutions are an evolution of VRS, grown due to the huge increase in e-commerce and last-mile operations. Whereas traditional routing solutions focused primarily on fleets and movements for the first mile, middle mile, and last mile to businesses, these new last-mile delivery solutions mainly focus on making deliveries to consumers and improving the consumer experience. These solutions have grown to extend from routing to visibility and customer experience as well as returns. Some solutions are also expanding into the first and middle mile.

Key findings and recommendations

Key findings of Gartner’s market guide are:

- Consumer demands and habits keep changing, making organizations shift more toward a B2C model. Vehicle routing and scheduling (VRS) and last-mile software vendors are reacting to these changes by adding more customer-centric and -engagement capabilities.

- COVID-19’s impact is still evident, creating new challenges as consumer demand increased after lockdown measures were eased. This instigated organizations to further outsource their transportation operations and actively promote employee retention. VRS and last-mile applications are adding more capabilities related to fleet and asset management and transportation outsourcing.

- As last-mile operations keep increasing and more trucks are on the road, organizations have raised concerns about areas like sustainability and operation efficiency. Carbon emissions analysis and capabilities to manage electric vehicles are starting to be requirements for VRS and last-mile software selection.

As a supply chain technology leader overseeing VRS and last-mile initiatives within technology and solutions for supply chain and operations, companies should identify vendors that meet the business requirements by assessing their capabilities. Compare VRS and last-mile offerings by evaluating multiple aspects of the vendor and its product, such as geography presence; industry coverage; and product capabilities such as optimization, automation, fleet management, and customer engagement. Validate the benefits of emerging VRS and last-mile capabilities — such as customer engagement, machine learning (ML), artificial intelligence (AI), and visibility — by identifying if these warrant adoption or replacement in your business.

The VRP market

The vehicle routing application market remains very dynamic, despite being a mature market. The evolution of applications due to new business needs has made vendors expand their capabilities in certain areas or even specialize their products in a specific area like last-mile operations. Vendors keep entering the market with new and more innovative solutions, providing applications that not only automate transport-planning tasks and reduce time and cost in transportation operations but also automate and optimize operations. Additionally, vendors are also increasing order visibility, customer engagement, and utilization of internal and external assets in their applications. Traditionally, routing focused mainly on fleets delivering to businesses (first, middle and last mile).

Newer solutions focus more on the last mile to consumers, following the increase in e-commerce and new customer demands. Routing algorithms are one of the components that define and differentiate VRS and last-mile solutions from other transportation solutions. However, vendors keep adding more capabilities that enhance the optimization options provided by the routing algorithms.

Gartner evaluated solutions offered by Aptean, Blue Yonder, Bringg, Dassault, Descartes, Dispatch Track, Far Eye, Fast Learn Smart, Locus, Manhattan, Onfleet, Oracle, Ortec, Trimble, and others.

Outsourcing and crowdsourcing

To maximize the use of the different routing options (static, dynamic, or real-time routing), vendors are adding options to outsource transportation to external fleets like parcel couriers or even crowdsourced or on-demand fleets. This adds more complexity to the solution because the underlying algorithms and data to support each routing type are different. According to Gartner, many vendors support these capabilities with their solutions in varying degrees and with varying performance (see Figure VRS Components, Gartner).

Source: Gartner

Extended capabilities

Vendors continue adding technological advancements to their solutions, especially in the areas of analysis and automation, providing more strategic capabilities for end-users to leverage. As well as the more traditional extended capabilities like transportation modeling, turn-by-turn navigation or 3D load building, vendors are adding new capabilities like automatic order adjustment, mobile solutions for drivers, and connectivity through API to external carrier networks.

Solutions also continue to add sustainability capabilities to their current repertoire. These include functionalities not only to calculate the carbon footprint for a specific delivery but also to manage electric fleets such as calculation of the driving range or the inclusion of charging stations in a specific route. Vendors are also investing in analytics and algorithm optimization improvements. The use of advanced technologies such as ML, AI, and advanced analytics is starting to be common among the vendors featured in the Gartner Market Guide. However, such use cases are still rather limited to areas of routing optimization.

Source: Gartner