The rapidly evolving challenges have left many parcel-carrier incumbents struggling. Even before COVID-19, senders and receivers expected more from parcel delivery: shorter and more predictable delivery windows (from next week to next day, to within two hours), more and more flexible delivery options (pick up in store, parcel lockers, favorite neighbor) and greener deliveries. Deloitte published its parcel delivery industry outlook.

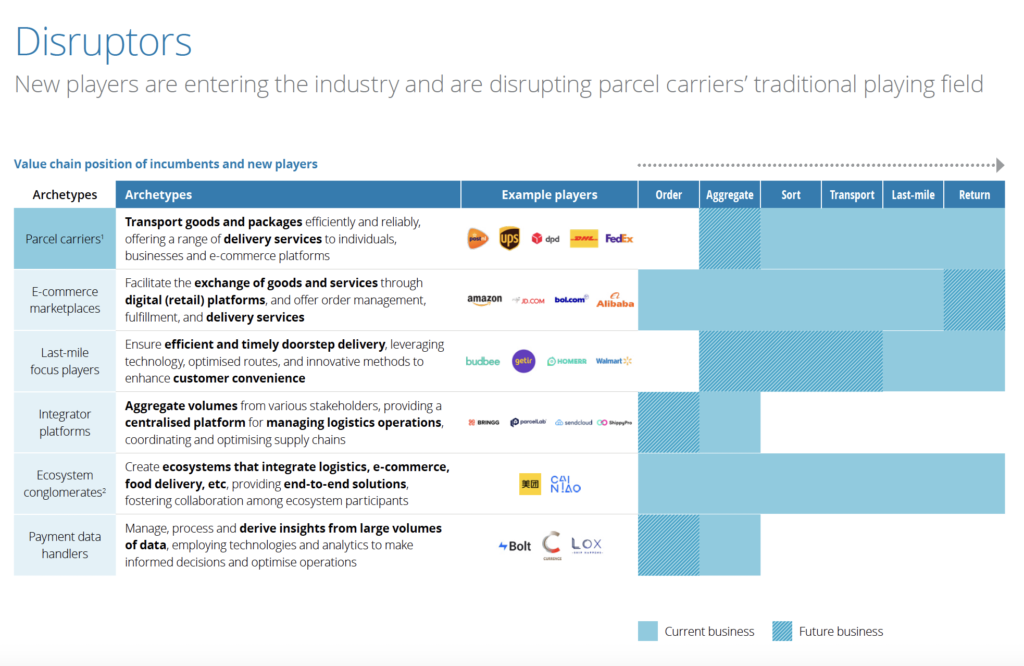

In that market, large customers became delivery competitors, like Amazon. New players started eating away at parcel carrier margins by offering niche delivery services and parcel-locker networks. Digital entrants started to pool parcel volumes from smaller web shops and negotiated lower prices with incumbent parcel carriers. This created a need for parcel carriers to compete more effectively, digitize, and innovate to stay relevant.

Fierce competition

Then COVID-19 came and gave e-commerce and home deliveries an unprecedented boost. This drove parcel carriers to rapidly scale up their sorting and delivery capacity. Two years later, the world looks very different. Although customer expectations are unchanged, e-commerce volumes have stagnated or declined in most markets.

This has created significant overcapacity in parcel carrier networks, which has intensified an already fierce competition. To make things worse, inflation-driven wage increases and the need to acquire a greener delivery fleet have led to a margin crunch: stagnating volumes, lower prices, and higher costs.

Unpicking the paradox

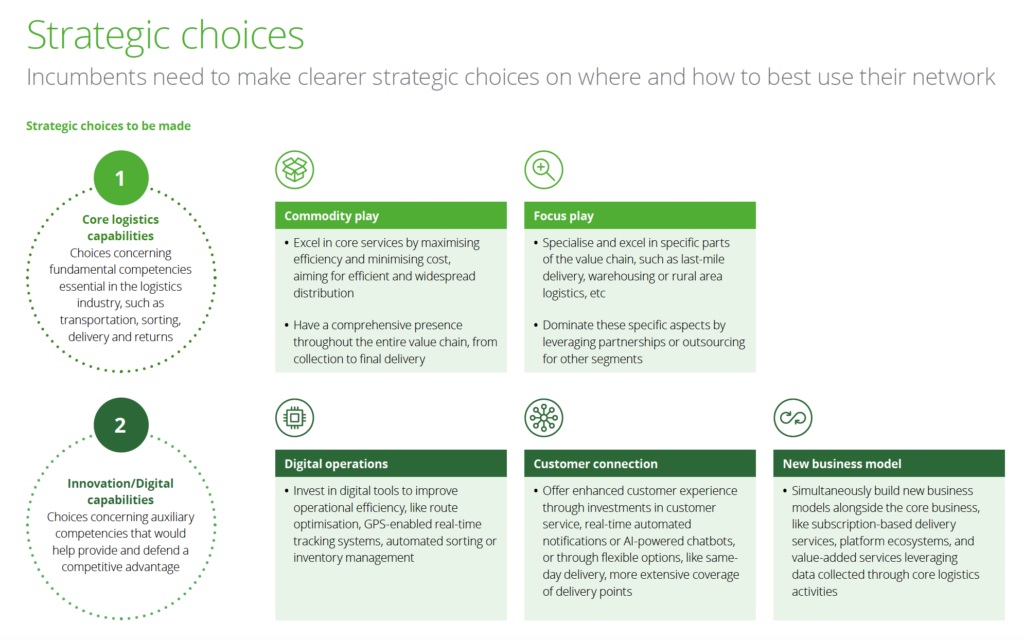

So, what should incumbent parcel carriers do to compete effectively? In all cases, they can better exploit their delivery network scale, core logistics capabilities, unrivaled customer access, and trusted brands. But this alone may not be sufficient to defend their margin and market share against competitors with vital innovation and digital capabilities.

Incumbents have an opportunity to digitize and innovate themselves despite budget constraints and limited innovation DNA. But where should they place their bets? Our POV offers potential solutions to restoring profitability based on making more apparent choices about the configuration of capabilities.

These choices revolve around exploiting parcel carriers’ existing strengths and selectively placing bets to participate in the disruption. Success lies in doing a few things well rather than competing on all fronts.

Deloitte sees three viable strategies:

- Core commodity: Provide lowest-cost, reliable logistics services (and nothing else) at scale as the core activities that are the underlying fundament for e-commerce fulfillment. Consider unbundling the network and offering capacity to competitors for specific activities (e.g., sorting, collecting).

- Value-chain specialization: Offer specialised solutions for one area in the value chain, focused on owning customer relations (e.g., Inpost focusing solely on shipping and collecting through parcel lockers).

- New revenue models: Deliver superior service with a truly customer-centric mindset— selectively fast-following disruptors and beating them at their game.

To select the best strategic option, parcel carriers should answer questions about their existing and desired capabilities based on their strengths and specific market context. The logistics transformation requires swift and decisive action from incumbent companies. In a world where adaptability is essential, the future of logistics belongs to those who can unpick the parcel paradox and seize the opportunities it presents.

Source: Deloitte