Heavy-duty vehicles (HDVs) are the transportation sector’s second-largest source of greenhouse gas emissions and its most significant source of air pollutant emissions globally. Given the large emissions footprint of HDVs, the Zero Emission Vehicle Transition Council (ZEVTC), whose membership represents countries accounting for about half of global vehicle sales and a quarter of global HDV sales, has identified these vehicles as a high-priority area of focus.

The ZEVTC paper reviews and summarizes the latest information on the pace of transition required for the HDV fleet to align with climate targets, the feasibility of such a transition given the latest data on technology availability and cost, potential pathways for adoption in various HDV segments, and high-priority policies and measures that governments would ideally adopt.

Key takeaways

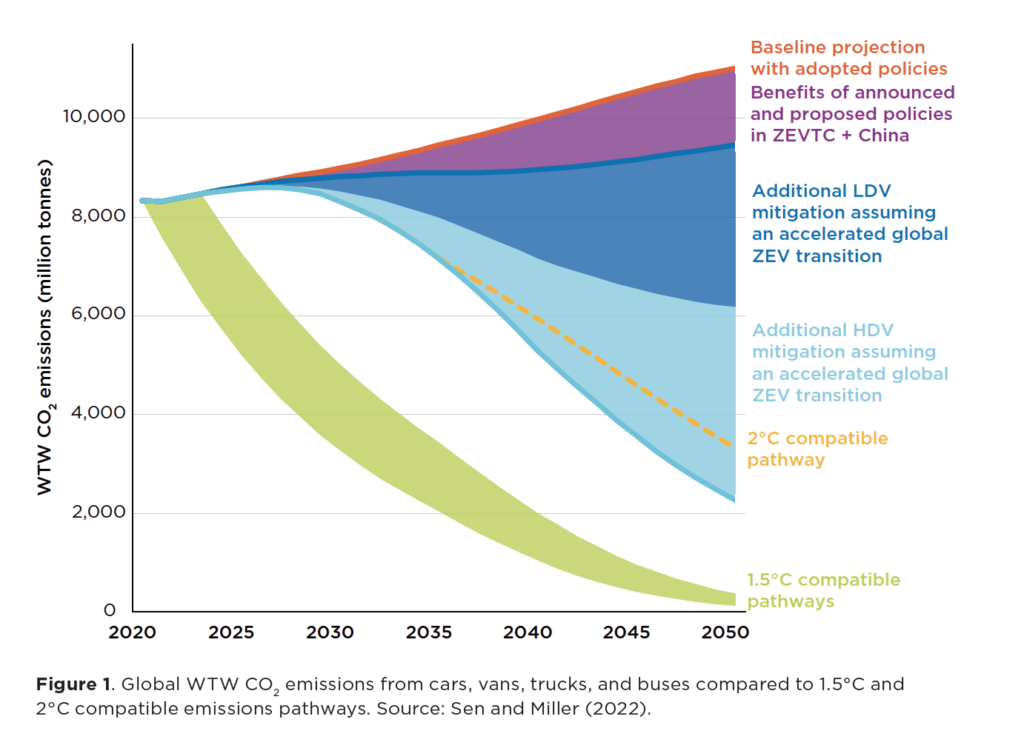

An accelerated global transition to ZEVs could reduce road transport CO2 emissions by 73% by 2050 compared to 2020 levels. Transitions to HD ZEVs represent approximately half of this emissions reduction potential. Achieving this level of ambition for the HDV sector would yield cumulative CO2 emission reductions of 47.5 billion tonnes between 2020 and 2050.

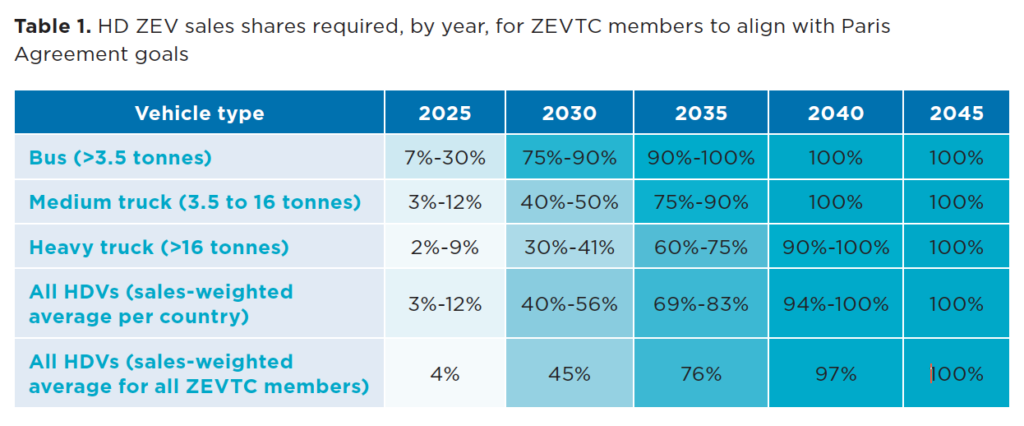

The ZEV share of global HDV sales needs to rise to 45% by 2030 and to nearly 100% no later than 2040 if the transportation sector fulfills its emission reduction responsibilities in line with the Paris Agreement goals. However, the needed pace of transition varies across individual HDV segments; greater ambition is required for segments, like buses, where zero-emission technology is commercially available and cost-effective.

A rapid transition to zero-emission HDVs will have significant global health benefits. Among G20 economies, actions to ensure that all new HDVs are either ultra-low or zero-emission could avoid 3 million premature deaths through 2050, equivalent to 5 trillion USD in health benefits. These benefits would be more significant with an accelerated transition to HD ZEVs.

Commercial availability and cost of ownership projections demonstrate that 45% zero-emission HDV sales in 2030 and 100% sales in 2040 are feasible goals for ZEVTC countries. Urban buses, urban delivery vehicles, and short-haul tractor-trailers are three HDV segments poised for early HD ZEV adoption. HD ZEVs in these segments are projected to become cost-competitive and commercially mature and can reach 100% sales as early as 2030 and no later than 2035 in ZEVTC countries.

Policies

Effective national policy design in five key areas—target-setting, regulations, incentives, infrastructure, and fleet purchases—is needed to accelerate the transition to HD ZEVs. For ZEVTC members, HD ZEV sales share targets of 45% by 2030 and 100% no later than 2040 would align with the Paris Agreement goals.

Regulations

Legally-binding vehicle regulations should drive the adoption of zero-emission technology; require, through the use of long-term targets, that manufacturers produce an increasing number or percentage of HD ZEVs each year; recognize differences in cost, emission footprints, and technology readiness among vehicle segments; and use allowances judiciously, to minimize their dilution of a regulation’s impact. In addition, HD ZEV regulations should align sales requirements for individual vehicle segments with phase-out targets.

Incentives

Fiscal incentives such as purchase subsidies and tax deductions bring forward the parity date for the total cost of ownership. However, incentive programs should be tailored to close segment-specific gaps in cost parity, have a revenue-neutral source of funding, and undergo regular review and revision to reflect technology development and cost changes.

Infrastructure

Governments are well-positioned to coordinate among stakeholders and to lead the development of infrastructure roadmaps, ensuring that build-outs align with vehicle electrification targets. In addition, governments should set policies to incentivize private sector investment while targeting public sector investment strategically where it is most needed in the early stages of market development.

Fleet purchase requirements

Fleet purchase requirements create market demand for zero-emission products that can further drive the supply of HD ZEVs and should be applied to public fleets of buses and trucks and large private fleets to spur the transition to HD ZEVs. In addition, purchase requirements should be aligned with targets and regulations for individual HDV segments.

Urban delivery vehicles

Urban delivery vehicles, including delivery vans and smaller straight trucks, make up most of the medium truck fleet in ZEVTC countries. ZEVTC estimates that medium trucks are responsible for 3% to 46% of total HDV CO2 emissions in ZEVTC markets. Urban delivery vehicles constitute 0.2% to 12.5% of total HDV sales in ZEVTC members, although definitions of this segment vary somewhat by country.

Like urban buses, urban delivery vehicles typically have predictable daily range requirements and duty cycles; urban delivery trucks and vans in the U.S. usually travel less than 200 miles (320 km) daily. Urban delivery vehicles are also characterized by return-to-base operations and long overnight dwell times, which fit well with depot-charging battery-electric technology.

The market for zero-emission delivery vehicles is advancing, with small-scale commercialization underway in several ZEVTC markets. As many as 20 zero-emission models are now available in Europe and the United States. Their ranges typically span 75–205 miles (120–330 km) depending on vehicle load and application. Fleet owners lead early deployments, often retailers and logistics companies. For example, Amazon ordered 100,000 electric delivery vans from Rivian in 2019 for entry into service by 2024.20 The logistics company United Parcel Service ordered 10,000 Arrival delivery vans between 2020 and 2024.

The economics of operating zero-emission urban delivery trucks and vans is promising, although the TCO estimates vary by level of utilization; greater daily driving distance for some delivery applications leads to greater cost savings and more favorable comparisons.

Source: The ICCT