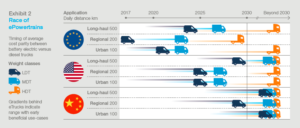

McKinsey’s latest research reveals that eTrucks could account for 15% of global truck sales by 2030, with favorable segments like urban light duty trucks reaching sales as high as 25 to 35% in China and Europe.

This is based on adoption curve scenario modeling for the US, China, and Europe and incorporates the trends of three main drivers for electrification.

Three drivers determine the attractiveness of eTrucks:

- The first driver for eTruck attractiveness is the cost parity of these trucks with diesel alternatives. Once eTrucks have lower total cost of ownership (TCO), many commercially driven business owners are expected to switch their fleets.

- The second is electrification readiness, which includes the availability of models on the market and supporting infrastructure, both driven by technology developments and actual investments/production.

- Thirdly, local and national regulations are enabling a supportive environment, in the form of stricter emission targets and (local) diesel bans.

Charging infrastructure

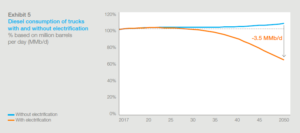

One element of electrification readiness is charging infrastructure. However, it may take some time for the impact of electrification to be felt, because the majority of diesel is consumed in the heavy truck segment, which is expected to be the last to switch to eTrucks.

The impact of truck electrification up to 2030 on total oil demand is, therefore, expected to be rather modest, offsetting demand growth in non-OECD countries rather than leading to an overall reduction—the local impact in early adopter regions, like Europe, could hit regional refineries before then. By 2050, the continued uptake of eTrucks could displace 3.5% of total global liquids demand. In terms of power demand, the switch could add 0.3% to global electricity consumption by 2030, rising to 3% by 2050.

McKinsey expects that early adopters will mainly charge their fleet overnight at their own depots or warehouses. Thus, they will not be dependent on public infrastructure. The inability to charge while on the road means battery size needs to match daily range, which pushes vehicle cost up.

However, once eTrucks become more mainstream, McKinsey expects the roll-out of supercharging infrastructure at distribution centers and along the main highways, enabling long-haul “refueling” along popular routes.

Source: McKinsey