A new set of competitors, on-demand urban delivery providers, has recently entered the B2C delivery market. These start-ups, including Deliveroo and Foodora in Europe, as well as DoorDash and Postmates in the United States, offer a different form of service: they integrate demand aggregation via their own mobile platforms with dedicated in-house operations to enable (almost) instant delivery.

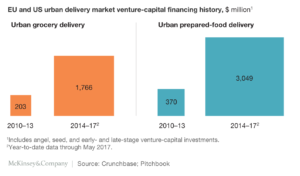

These innovations in the go-to-market approach and logistics model have attracted almost $5 billion in venture capital (VC) since 2014 in Western markets alone (exhibit), with leading players on average raising more than 90 percent of their total funding in that period. That’s shaking up the urban shopping and delivery landscape. McKinsey recently published a new report on these innovative companies.

Although urban delivery start-ups are striking a chord with consumers, their rise is ultimately due to investors’ bets on a virtuous cycle. Namely, the success of the urban delivery market depends on scale at a level that is only possible with heavy up-front investment.

McKinsey: “Two types of traditional players could make a mark. On the retail side, brick-and-mortar stores stand to recapture ground from fast-growing pure e-tailers. They alone have the dense network of physical stores to support same-day order fulfillment and delivery from the city as a warehouse. In logistics, incumbent parcel services—not start-ups—stand to gain at least 80 percent of the future same-day market. Only they have the critical capabilities that retailers will seek: proven expertise in consolidated network operations, synergies with significant base volume, and the commercial capabilities and standing big-customer relationships to support such deals”.

Read the full report on the McKinsey website.

Source: McKinsey