A decisive factor for ensuring the rapid market ramp-up of heavy-duty vehicles (>12 t) with climate-friendly alternative drivetrains is the deployment of refueling and charging infrastructures in line with the demand and synchronized with the ramp-up of the vehicles. Therefore, information on the vehicle ramp-up in the coming years can be obtained from the projected sales figures from truck manufacturers.

These sales figures and the strategic orientation behind them can be acquired in confidential talks in compliance with applicable antitrust law. The Federal Ministry for Digital and Transport (BMDV – Bundesministerium für Digitales und Verkehr) and NOW GmbH conducted cleanroom talks with several truck manufacturers in the summer of 2022. This report summarises the results.

Battery-electric trucks

The focus of this strategy is on the battery-electric truck. However, another strategy is being pursued by truck manufacturers pushing battery and fuel cell drivetrains simultaneously (“two-pillar strategy”). The representatives of the one-pillar strategy argue that the low operating costs of battery trucks lead to a better total cost of ownership (TCO) than those of hydrogen and fuel cells. In addition, battery trucks would achieve cost parity with conventional diesel trucks in a relatively short time—representatives of the two-pillar strategy point to many applications and usage scenarios in road freight transport. For long-haul transport and international, cross-border traffic, hydrogen, and fuel cells would be needed as a suitable drivetrain option.

Despite these different alternative drivetrain strategies, with a view to the EU heavy-duty vehicles’ CO2 standards for 2025, the focus is initially on battery-powered trucks for both groups due to their technological availability. Furthermore, battery-powered trucks are already sufficiently ready for regional and distribution transport.

The representatives of the strategy focusing on battery-powered trucks also believe that the coming MCS standard sufficiently defines the technological development path for long-haul transport and that development leaps in the battery’s durability and service life are in sight.

Drivetrain technology

For most manufacturers pursuing this drivetrain technology, the technology and series-production readiness of the fuel cell truck are not expected until the second half of the decade. The fuel cell truck’s application field is mainly long-haul and heavy-duty transport. Therefore, there is a need for development, especially in the robustness and system efficiency of the fuel cell. In addition, there is a need for the development and standardization of hydrogen storage technology, where several technological paths are being pursued (350 bar, 700 bar, liquid hydrogen (LH2)). The manufacturers cite the availability of green hydrogen at competitive prices as a key challenge.

ERS

No manufacturer places its strategic priority on overhead line technology (ERS). Some manufacturers are fundamentally opposed to any further technology. Others see few problems integrating an additional charging interface into a battery truck if overhead line technology is successfully established – especially if the overhead line infrastructure is adequate.

CO2 standards

The European heavy-duty vehicles’ CO2 standards are a decisive driver for truck manufacturers’ commitment to climate-friendly commercial vehicles. The truck manufacturers have aligned their previous drivetrain strategies and product policies with the current European targets. Therefore, a moderate increase in the EU heavy-duty vehicles’ CO2 standards for 2030 is already factored into the truck manufacturers’ considerations today.

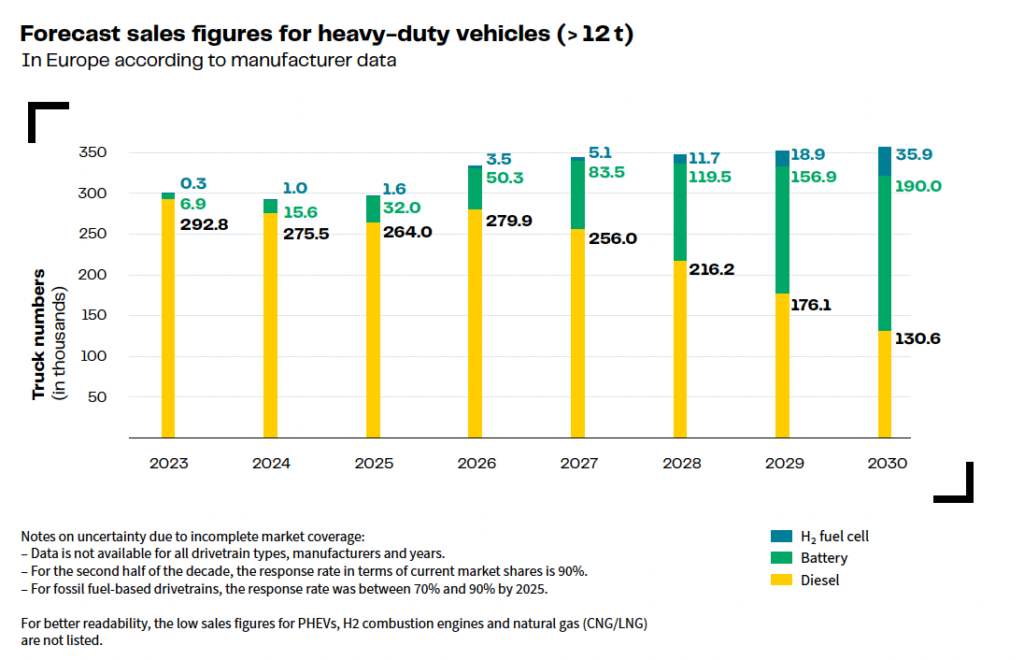

An excessive tightening of the targets for 2030 is classified as a threat to the industry’s existence. However, the analysis of the sales figures mentioned in the cleanroom talks and the company-specific and publicly communicated climate protection targets of individual companies prove that the manufacturers already expect very high shares of alternative drivetrains by 2030.

These figures go beyond the existing EU targets, in some cases significantly. According to the manufacturers’ information, around 75% of new registrations of heavy-duty vehicles in Germany and about 60% in Europe will be emission-free by 2030.

Cost parity

From the manufacturer’s perspective, apart from further technical development and future economies of scale, three factors are decisive for cost parity with conventional diesel trucks regarding total costs. Firstly, financial incentives through funding programs or a CO2-differentiated toll are mentioned; second, regulatory framework conditions such as the EU heavy-duty vehicles’ CO2 standards; and third, energy costs and their development. The latter would play a central role for heavy-duty vehicles, as the operating costs are particularly decisive for the economic efficiency of vehicle use. In this context, reference is made to Germany’s particularly high electricity prices compared to other European countries.

The manufacturers ‘ estimates differ significantly when it comes to achieving the cost parity of the alternative drivetrain options in detail. While some manufacturers see cost parity for battery-powered trucks compared to diesel trucks as early as the middle of this decade, other manufacturers believe that subsidies and significant financial incentives (e.g., a widely spread CO2 toll) will be necessary until the end of the decade.

The assessments of fuel cell trucks also differ considerably. While for some, cost parity with conventional trucks is not feasible in the case of hydrogen due to the energy efficiency disadvantages and the resulting costs, others see cost parity as realistic due to economies of scale in vehicle production and especially in the case of an economic ramp-up of hydrogen production.

Source:

NOW GmbH National Organisation Hydrogen and Fuel Cell Technology