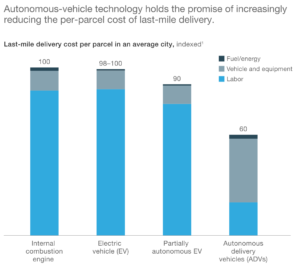

McKinsey presents an updated outlook for the last-mile delivery ecosystem, given the rapid development in technology. How will technological advances affect unit economics, customers, and competitive dynamics? McKinsey sees examples of technology piloting and testing across the globe. But they also see the beginning of series productions and scaling of technology deployment by several companies.

At every stage of development last-mile technology is making rapid gains. In the years ahead, McKinsey expects the adoption of a few key technologies.

Short term

McKinsey expects electric vehicles (EVs) and the increased presence of unattended delivery technology to form the first wave of technology that transforms last-mile delivery. This change is underway, as these technologies are market-ready and scalable, with each of them contributing to cost-effectiveness, customer convenience, or regulatory compliance. As cities tighten their emissions standards, it makes sense that the deployment of EVs in last-mile delivery will be among the first technologies to achieve significant adoption.

Near and medium term

In three to five years, large, semiautonomous delivery vehicles that follow parcel-delivery staff are expected to be the next trend to be adopted by companies in the parcel-delivery segment. This first step toward full automation will support delivery staff and increase productivity by cutting the time needed to drive and park vans.

In five to ten years, autonomous delivery vehicles will likely not need to be accompanied by human delivery staff at all and will represent the third wave of widespread tech-enabled parcel delivery.

Long term

Beyond 2030, it is expected that robots will take packages right to customers’ front doors. This technology represents crucial added value, namely customer convenience, as robots will be able to address the “last ten yards” of delivery. The first robot-delivery pilots are already happening. However, this technology is costly today, which means that these solutions are far from widespread deployment.

Eco-system: collaboration between vehicle providers and parcel companies

In the future, commercial vehicles (CV) players are likely to play a more important role in last-mile delivery, since they not only are well positioned to operate the autonomous delivery fleets (fleet management) but can also leverage their routing expertise. Courier, express, and parcel (CEP) players are well positioned to control the core steps—capacity management, tour optimization and planning, and sorting—as they will continue to play from a position of strength in the core business. Physical control of the parcels also gives CEP players possession of and control over the associated data, which is a vital input for process excellence.

These shifts would bring CV and CEP players closer together. To capture the full efficiency potential, both sides would need to collaborate closely in the routing of autonomous vehicles and together tackle capabilities challenges, such as suggesting possible parking spots and instant rerouting based on traffic information.

A close partnership also facilitates the integration and alignment of the routing software with the player’s related IT backbone (for example, tour planning and optimization IT). Beyond the technology advances that benefit CEP and CV players collectively, strong business partnerships can result in competitive advantages to individual players depending on the roles they play in the last-mile ecosystem.

For CV players, it seems advantageous to partner with one or more large CEP players who are leading in their home countries, because they possess the best data and typically the greatest innovative power. For CEP players, size matters, and smaller CEPs risk falling behind the innovation curve.

Source: McKinsey