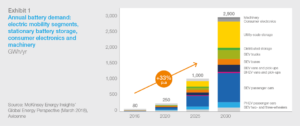

The uptake of electric vehicle (EV) technology appears to be progressing faster than expected, with industry forecasts routinely being revised upwards. This is in part the result of strong policy stimulus from the Chinese and Western governments, but is also increasingly due to favorable economics as battery costs have tumbled in recent years. However, the growth in battery demand has driven up raw material prices and given rise to concerns about potential cobalt, nickel, and lithium scarcities. Find out more detail in the latest research by McKinsey Energy Insights. McKinsey also look at potential solutions.

Battery demand for EVs

The key uncertainty is the actual demand for EVs. On the one hand, EV demand could be greater than expected as large OEMs pile in to assert their share in this growing market. On the other hand, price increases in key metals like cobalt and nickel could thwart the expected cost declines that have so far been the basis of optimistic EV demand projections.

Slower progress in terms of cost could delay Total Cost of Ownership (TCO) parity with ICE vehicles, which is an inflection point at which EV adoption accelerates. If TCO parity is delayed, EV demand may well turn out to be lower than expected.

Further, in the event of potential cobalt or nickel scarcities, OEMs can choose to reduce battery size. As this will reduce driving range, OEMs may be hesitant to pursue this option.

Battery technology developments

The key question is how fast battery technology advances and how fast less cobalt-intensive battery technologies can be commercialized and adopted. The pace of adoption is a key uncertainty that could potentially increase the risk of a nickel shortage, or aggravate the mismatch in supply and demand balance for both commodities if OEMs hold on to inferior battery chemistries for longer than expected.

There are also new battery technologies on the horizon that could lift energy density, such as Solid-State lithium and Lithium-Air batteries on a potential next horizon. Although the commercialization of these technologies seems distant, higher raw material prices will likely spur market parties to increase their R&D efforts.

Recycling and Re-use

Increases in the price of cobalt and lithium may cause recycling to become a lucrative business, with several startups already stepping in to seize the opportunity. Currently, there is little recycling.

Besides recycling, EV batteries can also still be re-used for stationary storage applications, thereby dampening raw material demand.

Source: McKinsey Energy Insights