Businesses are recognizing that electrifying their light commercial vehicle fleets is not only a successful mechanism by which they can demonstrate their green ambitions, but is also, increasingly, a solid economic decision. The new IDTechEx forecast report “Electric, Hybrid & Fuel Cell Light Commercial Vehicles 2021-2041” provides a detailed twenty-year outlook for the uptake of electric light commercial vehicles in China, Europe, the US, and the rest of the world.

The report contains market forecasts outlining eLCV sales, penetration, market revenue, and battery demand. Along with the forecasts, the report provides a background to the LCV market in each of the key regions, describes the current state of the eLCV market in each of these regions, highlighting the major players, and looks at the distinct drivers that are promoting the growth of electric light commercial vehicles including total cost of ownership considerations.

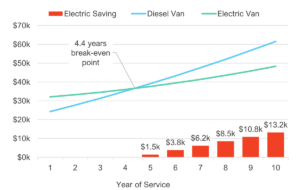

The LCV market is uniquely positioned for the rapid uptake of electric vehicles for several reasons. LCV purchase decisions are commonly made on a total cost of operation (TCO) basis. The operational cost saving of electricity, in place of diesel, is incorporated into the decision-making process of an LCV purchaser to a much greater degree than is the case for private customers in the electric passenger car market, where the upfront cost is more often the determining factor. Where the TCO benefit of an electric vehicle can be demonstrated, it becomes a competitive advantage for operators to run electric vehicles. For smaller vans, there is evidence that this is already the case. For larger vans, the TCO advantage is dependent on the level of government support through purchase grants.

Fleet managers have a detailed knowledge of the daily duty requirements of their vehicles. As LCV operators understand the daily mileage they require from their vehicles, range anxiety should not be an issue for the LCV market. OEMs must work with their customers, pre-sale, to understand first if their vehicle can meet the daily duty demand in the worst-case scenario (cold, fully laden, congested traffic, etc.) and further to this, to work with them to optimize the battery size and charging strategy to meet their customers’ needs, with the effect of reducing the upfront cost of the vehicle and minimizing the weight of the installed battery.

LCVs are often employed in urban environments as a key element in the supply chain. There is growing evidence of the impact that exhaust pollutant emissions, especially NOx and PM, have on local air quality and public health. Many large cities are in the process of introducing mechanisms to limit the access of polluting vehicles to city centers.

Non zero-emission vehicles will increasingly have to pay to access low emission zones within cities, increasing their operating costs. Urbanization and the continued growth of e-commerce are set to increase demand for the delivery of goods, but the tariff on exhaust emissions in congested urban areas will make eLCV the cheapest way to meet the demand.

The total cost of ownership is important to LCV purchasers and will be a driving force for uptake, however, in the short term, IDTechEx expects there to be a period of progressively larger pilot projects, conducted by commercial fleet operators to establish that eLCVs meet the businesses’ operational requirements. This period of validation will be necessary for fleet operators to determine that the vehicle range, load volume capacity, payload weight, and reliability in real-world operation are sufficient to replace the existing diesel fleet. Once this has been shown, the widespread replacement of aging diesel LCVs with eLCV will begin.